When deciphered correctly, data speaks volumes. Real estate stats analyzed and cross-referenced with market movements shed an abundance of light into the future. In other words, we can see what’s coming and can strategize for your benefit.

We anticipated a softer performance in Q3, the traditional summer slowdown (Click here to read our previous midterm predictions). A somewhat welcomed and natural recalibration of the marketplace after the surge in activity we have had this year so far. It has allowed the Cayman real estate market to calm, stabilize, and in essence, recharge for a strong Q4 and 2022.

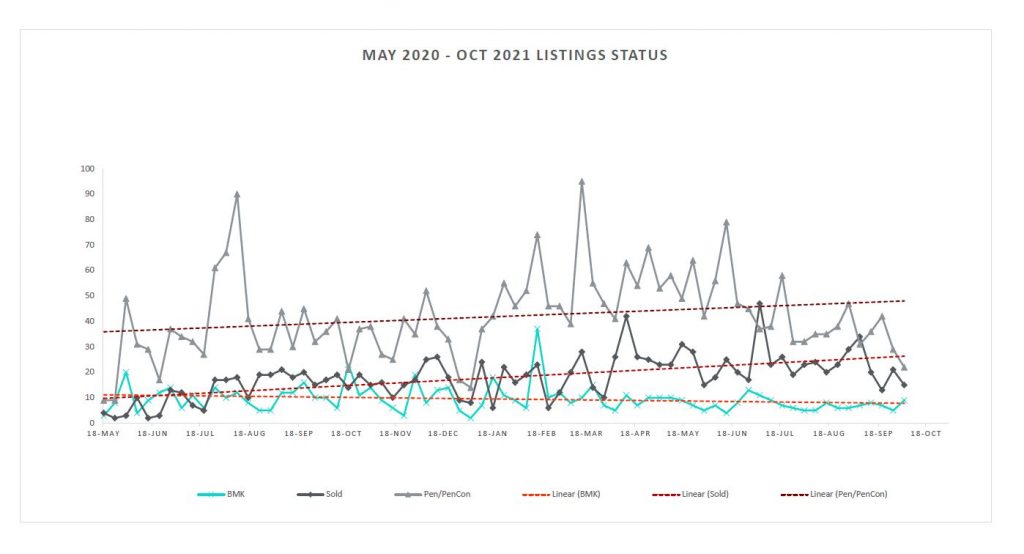

The market’s Q3 2021 performance:

1. LISTINGS: They are up! After 14 consecutive months of declining supply, the market has experienced a reversal. The total listing count is still at the lowest I have seen in my career, but the uptick from last quarter is there. Why? Those that were able to get off-island took longer than normal holidays, and this, coupled with limited international access to Cayman, meant fewer buyers on the hunt. In short, a softening of demand occurred. The anticipated summer slowdown allowed inventory to stick around longer. But now, more recently, the change in COVID regulations and continued border closures is causing the seasonal drop in activity to temporarily extend itself into our high season. Local activity and international buyer confidence experienced an extended pause at the end of September while we await for phase four reopening to occur. However, this too shall pass; borders will reopen, and activity will resume in earnest. For now, this is the opportunity for the market to stabilize and recalibrate. The Cayman product remains highly attractive and sought after. The demand will inevitably rise again. But to feed market confidence, it is time for us to welcome our visitors and investors back.

2. UNDER CONTRACT & SOLDS: Summer softening had an opposite effect on sales than it did with listings. Activity dropped away, meaning the number of properties going under contract and the number of closings declined. Current market stats show both Under Contracts and Solds tracking below their two year mean average. The shift is normal and anticipated. It is a typical seasonal slowdown of the market that will begin to reverse as we enter the last quarter of the year. Activity has already started picking up, yet the rate of increase is limited by the continued difficulty to enter Cayman.

3. BACK ON MARKET: Back on market is when a sale is unsuccessful. The property listing reappears in the MLS, meaning it is back up for sale. In short, more contracts closing means fewer back on market listings. For the past 16 months, the number of Back on Market properties has continued to decrease. This is a sign of a stable and confident market. Deals are closing. And the drop in activity we experienced over the summer did not change this positive trend. And despite continued border closures and new COVID regulations, we are certain the power and overall attraction of the Cayman real estate market will hold firm. Merely a blip in the overall market performance.

Predictions for the Cayman real estate market performance in Q4 2021:

1. SOFTENING OF DEMAND: As mentioned, the Cayman real estate market activity typically slows during the summer. While we anticipated this pause and fully expected it to be temporary, it’s is proving to be a bit more of an extended hiatus than we’d like at this stage. We should be transitioning into high season. Given the latest Government regulations and people’s extended summer holidays, many seem to be taking an extra second to consider and reflect on their next steps, including their property journey. As a result, Cayman’s real estate market could see a slower than normal start fourth quarter, yet we project a strong finish.

2. INTERNATIONAL PROPERTY INVESTORS: We are already seeing a dip in the number of enquiries from international high net worth buyers. Don’t get me wrong, enquiries haven’t stopped completely yet some have lost patience waiting for Cayman to open and are choosing to invest elsewhere. Nevertheless, we remain confident in the Cayman product. Smart investors will continue to recognize the unique advantages of our islands. Cayman provides an unmatched quality of living. A safe, private, and modern island with social, racial and political harmony and outstanding restaurants, healthcare and education. Furthermore, property investments in Cayman still yield a much better long-term return on investment when compared to other Caribbean jurisdictions. The wait for Cayman is absolutely worth it!

3. SHORT TERM RENTAL INVESTMENT PROPERTIES: Short-term rental landlords have been patiently holding out for the borders to reopen. They have been dealing with reduced income for many months, and for those international owners, they’ve not been able to use their own property. Frustrated with the latest news on continued closures and vaccination requirements, some owners are finally throwing in the towel and listing their property for sale. This is one of the reasons why we are seeing an increase in the number of listings coming to market. Our advice is to always consider your long term property journey and not react to short or medium-term trends.

4. NEGOTIABLE SELLERS: We began to see some more flexibility from sellers towards the end of the third quarter. A new willingness to negotiate, not necessarily on price, but a ‘sweetening of the pot’. For example, developers offering furniture packages or other incentives to get the last remaining units under contract. The extended closure of borders has forced some (by no means all) developers to rethink their numbers and made some frustrated international owners keen to offload. The shift is temporary but could provide some unique opportunities for buyers.

5. PRE-CONSTRUCTION PRICING: Developers have been facing ever-increasing costs to build, and in some cases, the profit margins are no longer feasible. As a result, we are seeing an exaggerated increase in pre-construction pricing to make up for the losses. In addition, depending on the developer and stage of the project, some buyers are being handed back their deposits. If you have purchased a pre-construction property, it is essential that you know where you stand. I encourage you to discuss this with your agent and developer.

6. LONG TERM RENTAL MARKET: Due to the lack of population growth, rental rates in certain areas will decrease if demand continues to soften. However, well-furnished properties in key locations with good amenity offerings will continue to command top rates, and the rental market as a whole will rebound once the borders reopen. Tourism will return, and with it, seasonal workers looking for long-term rental options.

Cayman real estate is a sound investment.

Population growth in Cayman is on pause. The longer the borders remain closed, the market will show exponential deviations from a seller’s dominated market. We have already seen indications for this in the third quarter. Normal trends and patterns will resume in the fourth quarter however critically, only if borders reopen as a matter of urgency. The market ebbs and flows, so we are extremely confident that any seasonal or extended softening is only temporary, and the recalibration of the market is ultimately a healthy thing. Property is a long-term stable asset class, and Cayman, in particular, is uniquely positioned as such. The savvy investor will recognize that their investment and lifestyle is safe in Cayman over the long run.

Recent Comments