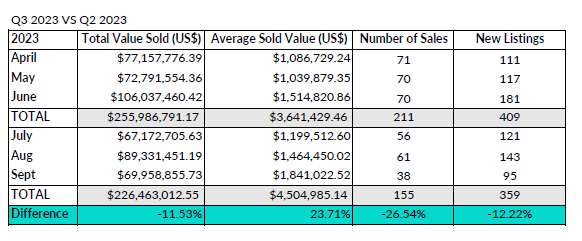

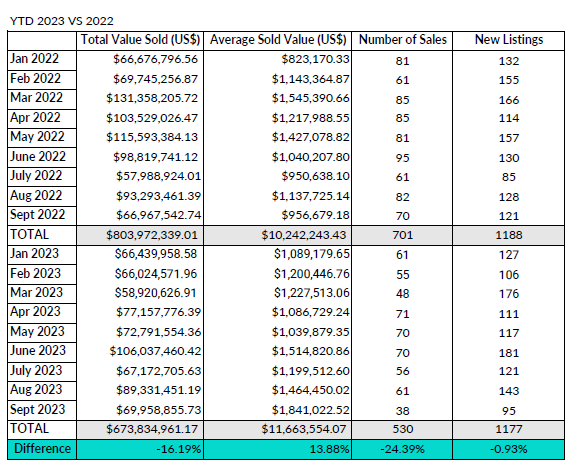

The quick facts. While still dangerously low, we have seen a slight uptick in the inventory available for sale as fewer sales are happening. Broadly speaking, property value remains stable despite a reduction in overall activity. Interestingly, the average number of days on the market for sales that have closed this quarter has decreased. Properties are being offered on and closing faster. This is a good sign for sellers and continues the trend of low inventory and, therefore, will continue the upward pressure on pricing.

(Source: CIREBA)

Current Market Analysis:

As projected, we had a slow summer. Not just seasonal but compounded by inflation, lending rates, cost of living, insurance costs, and the geopolitical environment at large. These factors all hamper market confidence, giving rise to what is coined (no pun intended) the Cost Crisis. This current inflationary cycle is one of many over the decades. It’s a sequence that we have seen before, instances like the Great Recession, hurricane Ivan, September 11, and now the post-COVID era. There is a big jolt to the marketplace, causing a pause and a recalibration, that can last between 12 to 36 months. The point is that we have endured many market shifts previously. The cycle repeats the same: pause, recalibrate and growth.

The Future of Cayman Real Estate:

Historical data has shown us that these cycles are followed by surges as the market rebounds. And while sales have slowed, property value on the whole has not dropped. Don’t get me wrong, there has been a shift. Prices are not increasing at the same rate as they were, and more price reductions are happening, as homes that were listed well above market value are coming down to meet the true market value. But the Cayman market holds strong. I say that with strong confidence, and further supported by the knowledge that population growth is still on the incline. A growing population requires more housing, exasperating an already low-supply market, and putting upward pressure on pricing.

New Developments

With the cost to construct being so high (labour, materials, shipping) and so many developments delayed because of the pandemic, for a while there weren’t many new developments being announced. A fact that further compounds pricing pressure in a low-supply market. Luckily, we have seen an uptick in new developments as of late: Point West, Dolphin Point, Altamar, and Sundance, to name a few. Fraser Wellon and Dart seem to have several new projects up their sleeves too. This is not only essential to support the island's population growth, but it also drives confidence that Cayman real estate remains a good investment.

The hold-back right now seems to be rules and regulations. Developers are chomping at the bit to get going again as the cost of materials comes down, and they reach completion on their backlog of projects. However, they are waiting for the Government to make some key decisions on their long-term Development Plan. What’s the new setback rule? What is the new height restriction? Are certain areas being rezoned for commercial, residential, or mixed-use? Development stimulates the economy (jobs, stamp and import duty), the demand is there (low supply and population growth), and yet the instructions on how to proceed are lacking.

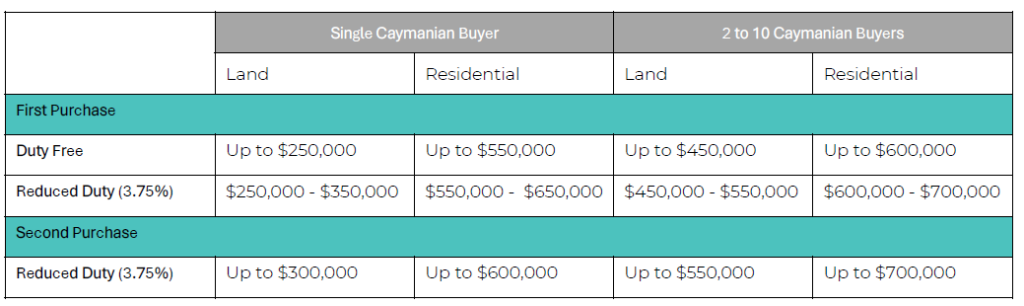

New Stamp Duty Concessions

The Government recently announced the revision to stamp duty concessions for first and second-time Caymanian Buyers, increasing the threshold to give more opportunities for people to get on the property ladder. If you qualify, it’s a huge leg up worth taking advantage of.

(Please Note: All figures are in CI dollars. Stamp duty concessions are available for Caymanian property purchasers only. Applicants must complete a stamp duty waiver application and submit it to the Ministry of Finance & Economic Development.)

The previous thresholds were established in 2019, so this is a long overdue amendment. However, given how much property value has increased in the last four years, I wonder if the threshold increase is enough. When I reported on the change back in 2019, I was, of course, ecstatic about the revision, but even then, I questioned if it was enough to make a difference. Fast forward another 4 years and the threshold receives another small nudge upwards. It seems like we are walking towards a goalpost that is jogging ahead of us.

I also feel the need to say, this is not a handout. Stamp duty concessions still require the investor to step up to the plate with confidence to make their first purchase. For the first-time buyer, this can feel overwhelming. We need to support these concessions with education and guidance on not just how to avail of the waivers but also all the other elements of property ownership. How to discern the right investment for you. How to obtain financing. And how to budget for the ongoing maintenance and upkeep so that the asset, your home, does not depreciate. It is the same thing with pension withdrawals for mortgage payments or home purchases. It’s a wonderful option for people, but we need to provide advice and assistance on how to best harness the benefit. How to make the smartest decisions to have the biggest impact on your long-term financial health.

Cayman Property Advice:

Sellers

- Go to market with a strategy that reflects the current and projected market (this includes but is not limited to the decision of whether to do minor repairs and staging or not, your pricing and marketing strategy, which should not be a set-it-and-forget-it approach.)

- Price according to the current inflationary cycle and your timeline to sell.

- Consider delaying the listing and renting it out to cover your carrying costs in the meantime.

Buyers

- Get on the property ladder now. It may seem like the wrong time. However, it’s exactly the right time to buy. Despite interest rates and the cost of living being higher than you may have seen before, we know prices will go up again in the next year or two, so buy what you can afford today. It might not be your forever home, but it's your stepping-stone. And when interest rates come down, and you haven’t over-extended yourself, that stepping-stone will be worth well more than you bought it for.

- Real estate is a long-term asset that appreciates in value over time, so the earlier you buy in, the more you stand to earn. Don’t wake up in two years’ time when prices have risen again and be wishing you had bought today.

- Leverage pension withdrawals and stamp duty waivers if you are a Caymanian buyer.

Owners and Landlords

- Increased insurance and mortgage rates can be tough to navigate. Have discussions with your bank to potentially renegotiate your mortgage payment schedule to reduce interest payments. (For example, weekly instead of monthly payments and extending the term back to 25 or 30 years if feasible.)

- Do not neglect your home upkeep or maintenance. Now might not be the time for capital improvements, but do not cut back on the ongoing care of your home. This will negatively impact your property value and cost you more in the long run. Consider it preventative maintenance.

(Please note that this is a broad analysis of the overall market. Please reach out for a bespoke detailed report tailored to your personal property journey).

Cayman is Bound for Glory

Cayman is growing. It doesn't matter about the current inflationary cycle; the reality is we are a highly desirable location to live and work. Regardless of your opinion on how we should grow, one thing is for sure: population increase is already happening. So, the current cost crisis or post-COVID era is a blip in the market and your real estate investment.

Property is a long-term investment. Population growth, low inventory, as well as continued inward investment, mean pricing will inevitably increase. Current owners, rest easy, your investment is safe. And to future owners, Confucius says: “The best time to plant an oak tree was 200 years ago, and the second-best time is today.” So, plant your oak tree. Get on the property ladder now, because when property value soars, you'll wake up in three, five, or seven years thanking your younger self for having made the smart choice.

Access to exclusive content

Sign Me upEvery week, we’ll send you exclusive content information to help you along your property journey. Don’t worry – good stuff only.