A Quiet Confidence: Cayman’s Market in Motion

If you were expecting fireworks in Q2, you may have missed the beauty of what really unfolded: steady, thoughtful momentum. Cayman’s real estate market didn’t make headlines for massive leaps, but what we saw was arguably more important.

There was a quiet confidence running through the quarter. Transactions were up, dollar volume held firm, and despite some shifts in pace, the belief in Cayman’s long-term value stayed strong.

No dramatic spikes. No sudden drops. Just intentional, resilient progress—which, let’s be honest, feels like a win in today’s world.

The Numbers Behind the Narrative

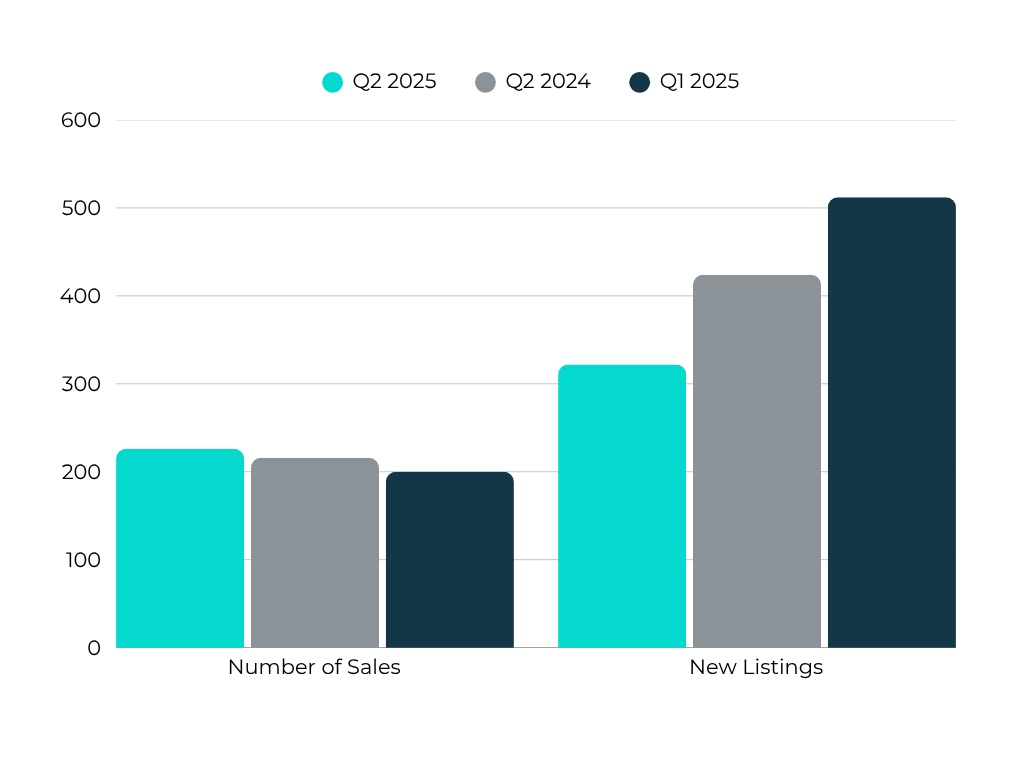

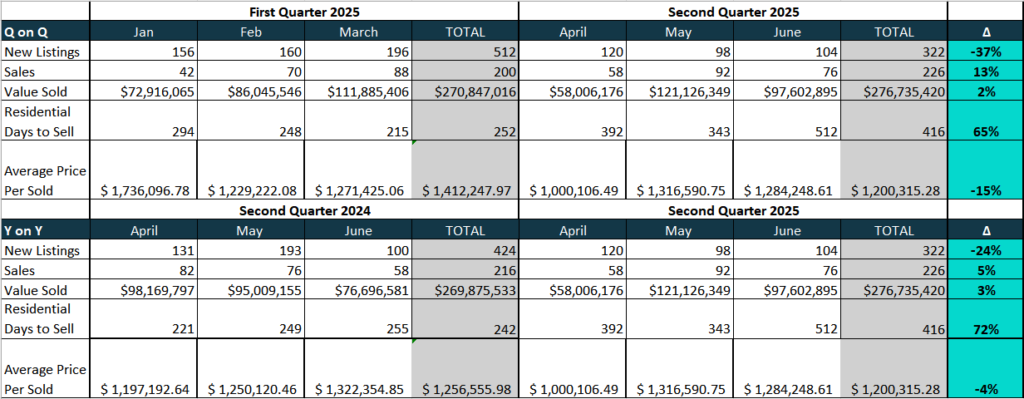

By the end of Q2, 226 properties had changed hands—an encouraging 13% rise from the 200 sales recorded in Q1. May stood out as the strongest month, with 92 deals closed and over $121 million in total value.

One of the more noticeable shifts was on the seller side. We saw 322 new listings come to market—a significant drop from Q1’s 512. This isn’t a sign of worry, but rather a recalibration after the initial surge in activity earlier this year.

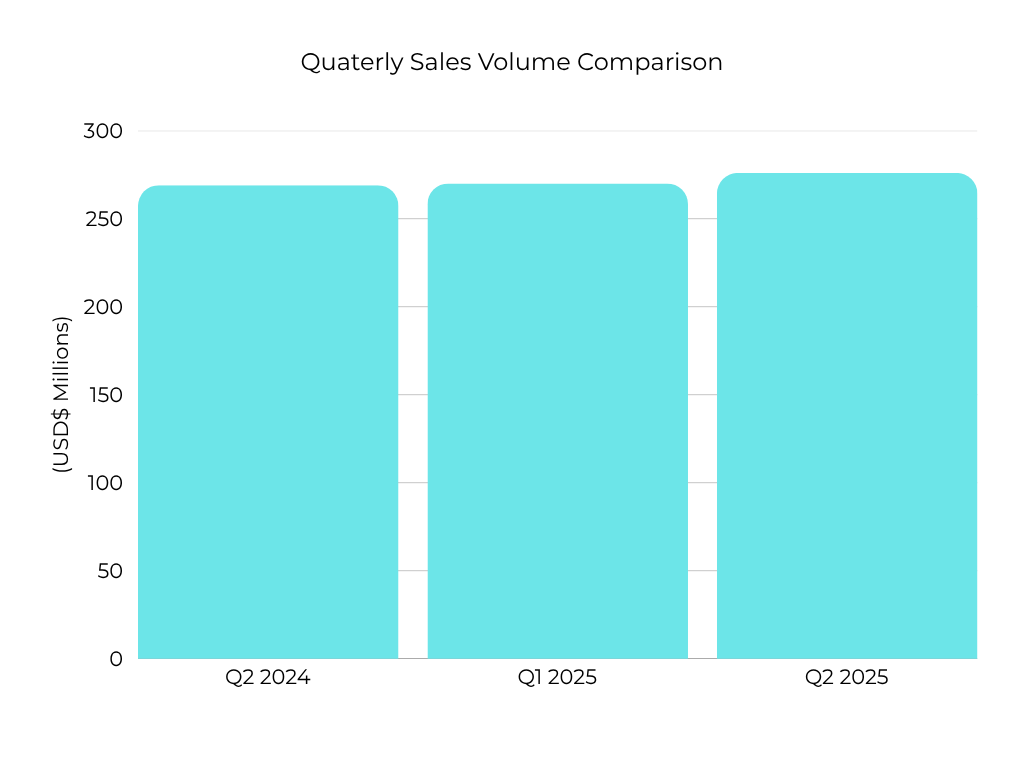

In terms of overall sales volume, Q2 ended at $276.7 million—just over a 2% increase from the previous quarter. But what’s interesting is how that number was achieved. Unlike Q1, which benefited from a few bulk sales, Q2’s strength came from a broader spread of activity, particularly in the luxury and mid-market segments.

What may raise more eyebrows is the average time it’s taking to sell a residential property. That number jumped from 252 days in Q1 to 416 days in Q2. It’s a clear sign that buyers are taking their time, weighing their options, and moving with more intention than urgency.

So, What’s Really Going On?

Let’s be clear—this isn’t a slowdown, and it’s certainly not a signal that Cayman real estate is losing its shine. What we’re seeing is a rebalancing.

Buyers haven’t disappeared; they’re just being more strategic. With higher interest rates still in play and global uncertainties lingering, it makes sense that people are doing more homework and taking fewer risks.

Sellers, meanwhile, are adjusting their expectations. After Q1’s surge of optimism, many are pausing to reassess but not retreating, just being realistic about what the market will bear.

And through it all, the market itself continues to move forward, maybe not at a sprint, but at a steady, confident pace. Very Cayman, really.

Who’s Buying, What’s Selling?

The luxury market, especially properties over $3 million, remains solid. Serious cash buyers, legacy home seekers, and those relocating globally continue to show strong interest. May in particular saw a flurry of high-end activity—less window shopping, more real commitment.

On the other end of the spectrum, homes under $3 million continue to drive most of the activity. These buyers are often navigating interest rates carefully, comparing properties with more scrutiny, and negotiating firmly. It’s not that they’re hesitant, it’s just that they’re paying attention, and rightly so.

The commercial space is still a bit soft. Inquiries are on the rise, and there’s genuine interest from investors, but actual transactions remain slow. Much of this hesitancy ties back to pending government reforms, which could reshape the landscape in meaningful ways.

What We’re Watching for Q3

As we look ahead, there are three key themes we’re keeping a close eye on:

First, government reform. With new leadership stepping in back in May, there’s momentum building around policy changes that could impact both buyers and developers. From potential stamp duty relief for Caymanians, to incentives for projects that benefit the local community, to immigration and residency adjustments: these shifts could create both new opportunities and new timelines to navigate.

Second, interest rates. While they’ve held steady lately, they’re still relatively high—especially for those relying on financing. This will likely continue to put pressure on the sub-$1.5 million market, where affordability is more sensitive. On the flip side, cash remains a powerful advantage, particularly in the higher-end space.

And third, affordability tension. Cayman’s younger generation continues to feel the squeeze. It’s not a new issue, but it’s becoming more pronounced. At Property Cayman, we remain deeply committed to helping where we can. Through our CARES initiative, we’re advocating for smart housing policy, supporting first-time Caymanian buyers, and partnering on community-driven solutions.

What It Means for You

If you’re thinking about buying, now might be a good time to stay alert. While there aren’t as many listings to choose from, there are still gems out there—and if something feels right, being ready to act can make all the difference.

If you’re selling, pricing and presentation are key. Today’s buyers are informed, cautious, and deliberate. Homes that are priced too ambitiously may sit. But those that are well-aligned with the market are still moving.

For investors, the coming months could bring some regulatory clarity—especially as the government’s reform agenda takes shape. Being ready to move when the picture clears could be a smart play.

And for everyone else: Cayman remains what it has always been—a globally respected, lifestyle-driven, safe and stable place to invest in property and in life.

Final Thoughts

The Cayman market isn’t about hype, it’s about heart. It’s about long-term value, legal certainty, and a way of living that continues to attract people from all over the world.

So, whether you’re planning your next move, testing the waters, or just rethinking your goals, we’re here to help you navigate it all—honestly, thoughtfully, and with a little Cayman flair. Let’s talk strategy. Let’s find what’s right for you.

(Please note that this is a broad analysis of the overall market. Please reach out for a bespoke detailed report tailored to your personal property journey).

Access to exclusive content

Sign Me upEvery week, we’ll send you exclusive content information to help you along your property journey. Don’t worry – good stuff only.